Mastering Trading Psychology: 5 Key Strategies for Emotional Control and Success

- papixcorpse

- Sep 26, 2024

- 2 min read

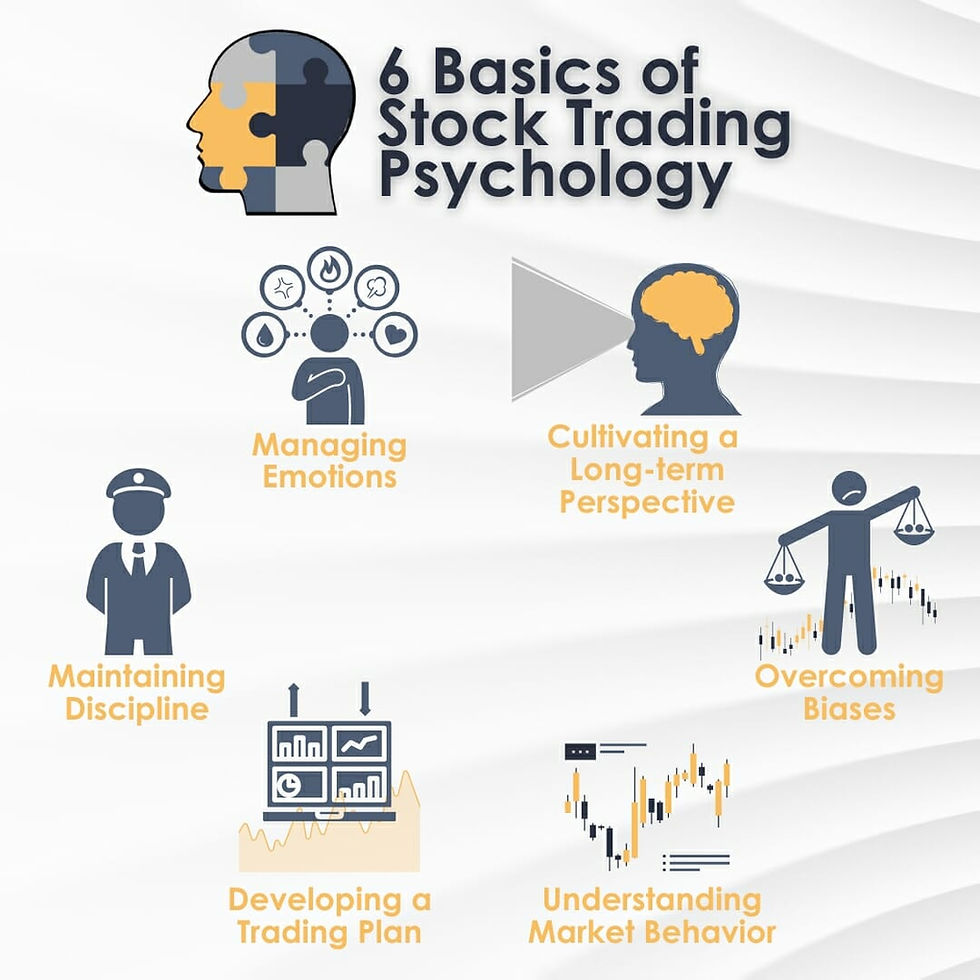

Trading in financial markets can be an emotional rollercoaster. While knowledge and skills are crucial, mastering the psychological aspects of trading is often what separates successful traders from the rest. Understanding and controlling your emotions is essential for making rational decisions and achieving consistent profits.

The Impact of Emotions on Trading

Fear and greed are two primary emotions that significantly influence trading decisions. Fear can lead to premature exits from profitable trades or avoiding potentially lucrative opportunities. On the other hand, greed may cause traders to hold positions for too long, hoping for unrealistic gains, or take on excessive risk.

Key Psychological Challenges in Trading

1. Overconfidence Bias

After a string of successful trades, traders may develop an inflated sense of their abilities. This overconfidence can lead to taking on larger positions or ignoring risk management principles.

2. Loss Aversion

Traders often feel the pain of losses more intensely than the pleasure of gains. This psychological tendency can result in holding onto losing positions too long or cutting winning trades short.

3. The Gambler's Fallacy

Some traders mistakenly believe that past events influence future outcomes in random processes. This can lead to poor decision-making based on perceived patterns that don't actually exist.

Strategies for Improving Trading Psychology

1. Develop a Robust Trading Plan

Creating and sticking to a well-defined trading plan can help remove emotional decision-making from your trading process. Your plan should include clear entry and exit criteria, position sizing rules, and risk management guidelines.

2. Practice Mindfulness and Stress Management

Incorporating mindfulness techniques and stress-reduction practices like meditation or deep breathing exercises can help you maintain emotional balance during volatile market conditions.

3. Keep a Trading Journal

Maintaining a detailed trading journal allows you to track your decisions, emotions, and outcomes. This self-reflection tool can help identify patterns in your behavior and areas for improvement.

4. Set Realistic Expectations

Understanding that losses are a normal part of trading can help reduce emotional reactions to individual trades. Focus on long-term performance rather than short-term results.

5. Utilize Stop-Loss and Take-Profit Orders

Implementing automatic stop-loss and take-profit orders can help remove emotions from the decision to exit a trade. This systematic approach ensures you stick to your predetermined risk management strategy.

The Role of Discipline in Trading Success

Discipline is a cornerstone of successful trading psychology. It involves consistently following your trading plan, even when emotions tempt you to deviate. Disciplined traders are more likely to weather market volatility and achieve long-term success.

Conclusion

Mastering trading psychology is an ongoing process that requires self-awareness, practice, and commitment. By implementing these strategies and continuously working on your emotional control, you can significantly improve your trading performance and achieve more consistent results in the financial markets.Remember, successful trading is not just about market analysis and strategy – it's also about understanding and managing your own psychology. As you develop your skills in this area, you'll be better equipped to navigate the challenges of trading and capitalize on opportunities in the market.

Comments